Donate back to local charities in Malaysia and help your neighborhood community. It also has a dedication towards conducting relevant research in the various faculties it runs.

United States High Resolution Bitcoin Concept Ad Ad High States United Concept The Unit Spiritual Warfare Bitcoin

The dgir gazettes the name of the institution or organization in the government gazette after the application is approved.

. Financial Sector Participants Directory - Bank Negara Malaysia. The donation threshold above which a donor needs to be included in the list of donors provided to the IRB has been increased from RM10000 to RM20000 in line with the Budget 2020 proposal see Special Tax Alert. Choose from the many charities that are listed here to get started.

Gift of money to Approved Institutions or Organisations. During the pandemic period the safety of students in higher education institutions was important and this was guided by the advice and direction of the national for the higher. Branch Campuses of Foreign Universities.

Business registration No. Choose the cause you would like to support STEP 2. Amount is limited to 7 of aggregate income.

Private universities in Malaysia are institutions that award undergraduate and post-graduate degrees. Sau Seng Lum is a leading non-profit health system in Malaysia. At the moment of writing their goal is to raise about S164944 RM501348.

There are few ways to donate to WWF-MalaysiaOnline Donation you can donate to us via our official donation page. Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of.

Heres quick scenario to briefly illustrate how the whole thing works. Investing in subsidiaries with the total number of shares held not exceeding 49 total paid up capital. Allocate funds to provide frontliners with face masks COVID-19 test kits and more ventilators to be used by patients in serious conditions.

Give back to environmental protection fight against animal cruelty and support elderly patients. The charitable institution organisation must spend at least 50 or such percentage as may be determined by the Director General of its income including donation received in the previous year for the activities which were approved to achieve its objectives for the basis period for a. Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government.

Cash donation paid to approved institutions or organisations Gift of money orcontiibutioninLkino to any sports activity or approved 700 OF sports body Gift of moneyorcostofcontribution AGGREGATE INCOME in-kind to any project of national interest approved by the Finance Minister Gift of artifacts manuscripts or aintings NONE. Category of License Approval or Registration. Ahmad has an aggregate income of RM60000 and makes a donation of RM5000 to an approved institution in March 2021.

Here is the list of contributions under donations gifts. The centre has been continuing its mission to provide subsidised haemodialysis service to the underprivileged society since 1994. SSL has established a few diverse centres in Petaling Jaya.

514 057 600 134. Subsection 44 6 2. Amount is limited to 7 of aggregate income Subsection 44 11B 4.

CIMB 8000-7929-08 MERCY Humanitarian Fund. And you must keep the receipt of the donation. Amount is limited to 10 of aggregate income Subsection 44 6 3.

Gift of money made to any approved institution organization or fund approved by the DGIR is also allowed as a deduction but restricted to 7 of the aggregate income of an individual. Highlights of Budget 2020. Requirement for list of donors to be provided to the IRB.

Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body. The Revised Guidelines also states that the approved institution or organisation is not allowed to issue tax-exemption receipts to donors who fails to provide their complete personal details stated above. List Of Guidelines Under Subsection 446 Of The Income Tax Act 1967.

A deduction is allowed for cash donations to approved institutions defined made in the basis period for. MBB 5621-7950-4126 Cash or Cheque payable to MERCY Malaysia or MERCY Humanitarian Fund delivered to our office. For cash donations or direct transfer into our account please fax or email us your.

Malaysia COVID-19 Charity Drive. Increase in deduction limit for donations. Pay by credit or debit card.

InstituteOrganization Effective Date Valid Until. TYPES OF INSTITUTIONS OR ORGANISATIONS ELIGIBLE TO APPLY FOR APPROVAL UNDER SUBSECTION 446 OF THE ITA 1967 An institution or. Curtin University of Technology Australia.

With effect from the YA 2020 the restriction on that allowable deduction is increased to 10 of the aggregate income of an individual. PERSATUAN MENCEGAH SALAH GUNA DADAH MALAYSIA PEMADAM 8 JALAN LEDANG50480 KUALA LUMPUR Kuala Lumpur 1976-03-21 PERSATUAN PENJAGAAN PALIATIF JOHOR BAHRU JOHOR PALLIATIVE CARE. Select your preferred method.

Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body. To receive the receipt in accordance with lhdn malaysia regulations. Tell us how much you would like to donate STEP 3.

There are 4 branch campuses of foreign universities in Malaysia. Gift of money or cost of contribution in kind for any Approved Project of National Interest Approved by Ministry of Finance. GIRO Internet Bank transfer or ATM bank-in Donation form.

Been approved under subsection 44 6 of the ita 1967 an approved institution or organisation is prohibited from. Any organisation or institution which is approved under subsection 446 will automatically be granted tax exemption on its income except dividend income under paragraph 13 Schedule 6 Income Tax Act 1967. Based on the revised guidelines the donor is required to provide complete information of the details stipulated below in order to obtain an official receipt or tax-exemption receipt from the approved institution or organization.

Gift of money to the Government State Government or Local Authorities.

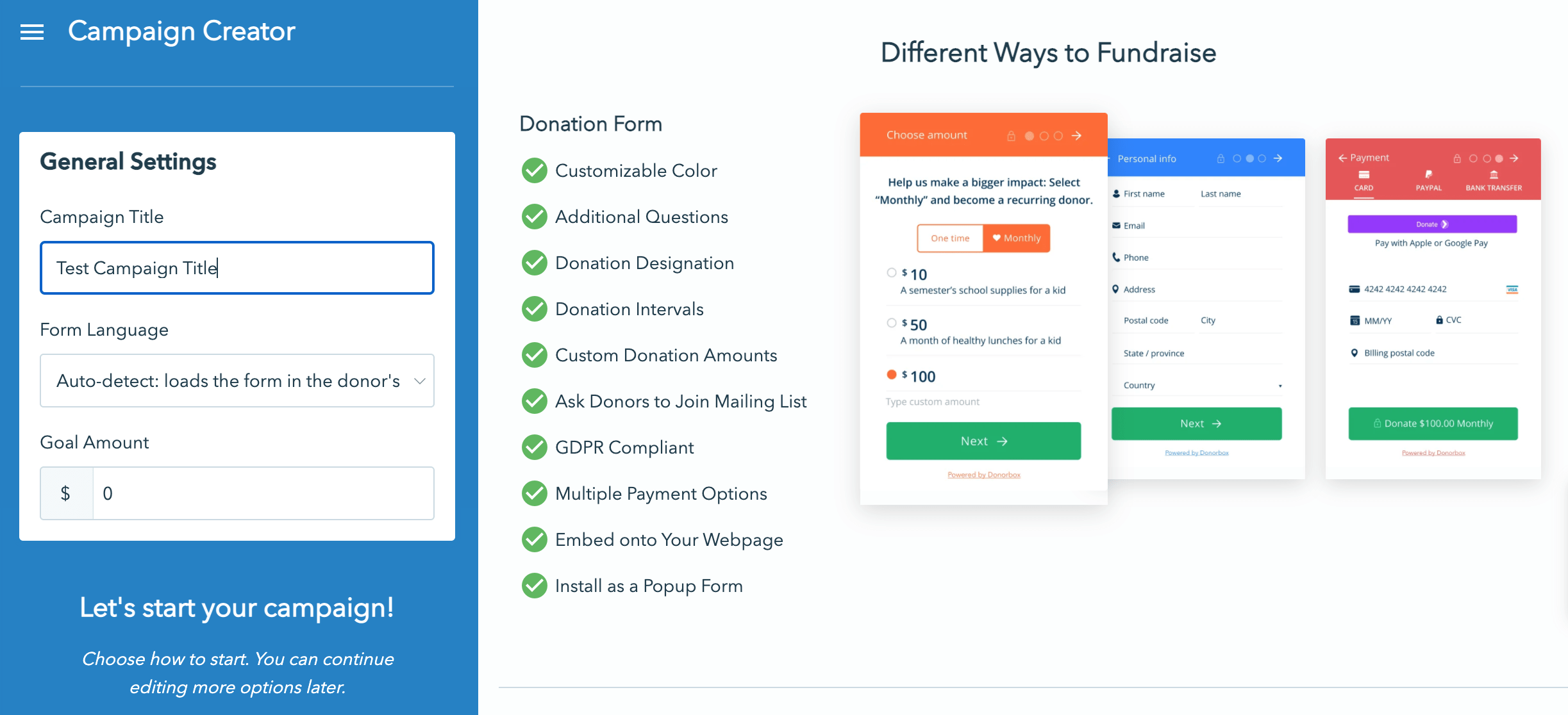

How To Accept Online Donations With Stripe Stripe For Fundraising

The Different Types Of Charities Gogreendrop Blog

165 Ptpl Kota Bharu Students Collect Donation To Help Less Fortunate Society At Rural Transformation Center Rtc Tunjong Kela Msu College Kelantan Kota Bharu

J O S E P H S M Organ Donation Campagin Poster College Project Organ Donation Donate Life Kidney Donation

Updated Guide On Donations And Gifts Tax Deductions

Organ Waiting List By Age United States 2021 Statista

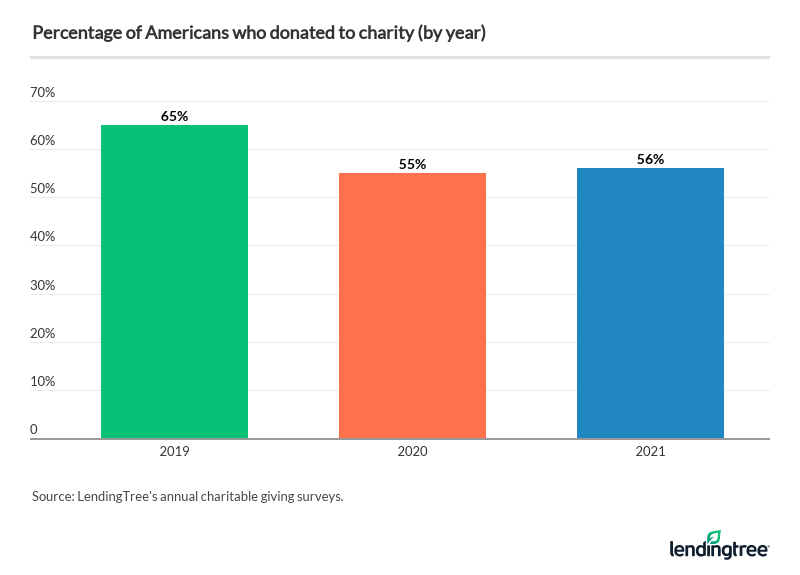

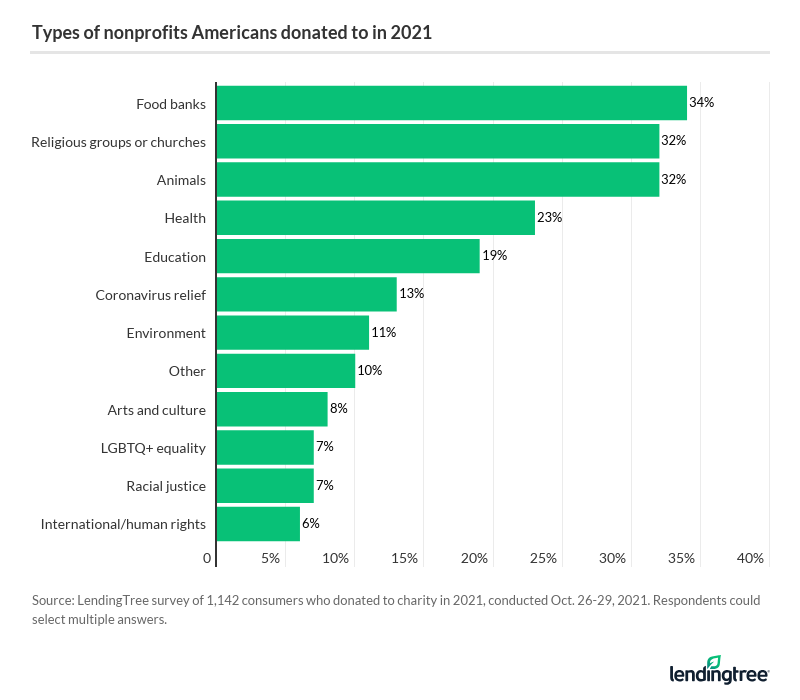

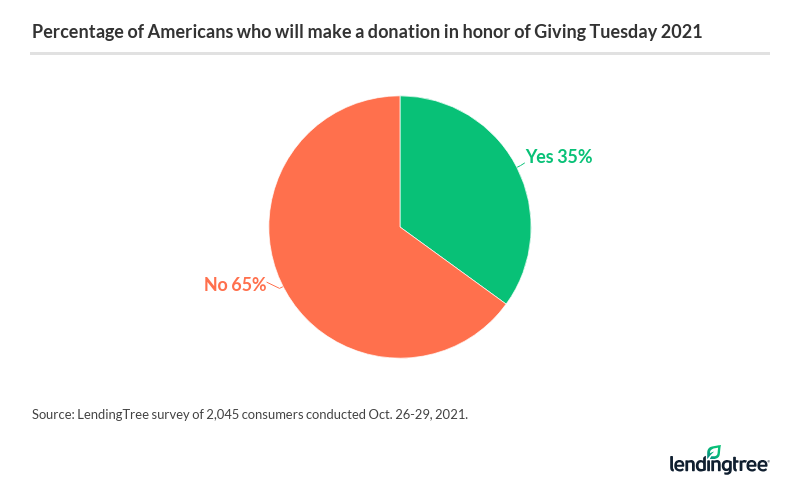

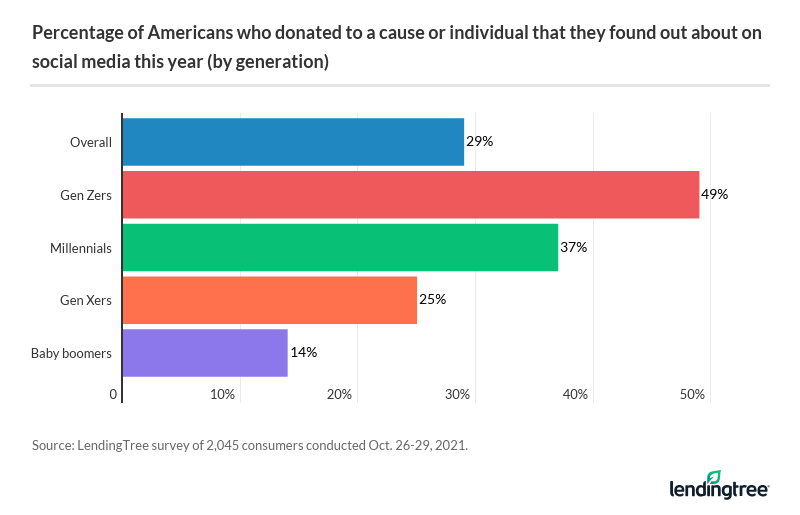

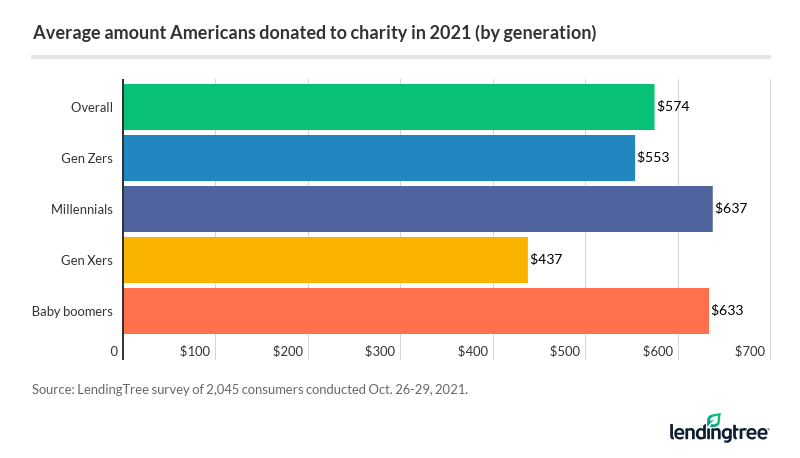

56 Of Americans Donated To Charity In 2021 Lendingtree

How To Collect Online Donations In 8 Steps

56 Of Americans Donated To Charity In 2021 Lendingtree

Harvard Received 1 4 Billion In Donations Last Year Infographic

Crackdown Coming On Donation Bin Trash Local News Northwestgeorgianews Com

Tender Authorization Letter Authorization Letter To Purchase Tender Document Sample Letter Sample Lettering Cool Lettering

56 Of Americans Donated To Charity In 2021 Lendingtree

Free Letter Of Intent To Donate Pdf Word Eforms

Pdf Donate Time Or Money The Determinants Of Donation Intention In Online Crowdfunding

56 Of Americans Donated To Charity In 2021 Lendingtree

College Admissions Counseling Ivywise Georgetown University Scholarships For College Online University

56 Of Americans Donated To Charity In 2021 Lendingtree